British Columbia

CANADA VACANCY RATE

The vacancy rate across the country reached a two decade low amid a cooling real real Estate market, with rental a more affordable option. The vacancy rate dropped to 1.9 percent, because of increased immigration, and home Buyers being priced out of the market, and not qualifying for higher interest Mortgages.

In 2021, the national vacancy rate was 3.1 percent. Further rental pressures are expected as some 500,000 new immigrants are expected To arrive in 2024. Toronto and Vancouver are the biggest magnets with the strongest Economies.

In Vancouver the average rent is $2000 per month, and in Toronto $ 1765 On a turn- over the average the average rent increase is 18 %, whereas in Vancouver Rent increases are limited to 2 % annually, well below the inflation rate. Condos have increasingly become a major supplier of rentals and account for 19 % Of the national rental stock. The largest share is in Vancouver at 42.5 % ( Globe Newspaper 27th January, 2023

The Federal Budget 2022 has housing as its most important focus

Policies are being proposed for additional building, savings for first-time home buyers, anti- flipping laws, and restrictions on foreign buyers of non-recreational homes for the next two years.

A new Housing Accelerator Fund of $ 4 billion over the next 5 years will provide support to Municipalities; they can give developers annual per door incentives for new construction or upfront funding for investments in housing planning and delivery.

In 2021 Vancouver received 100,000 new residents, of which 60% were through immigration and the balance from other parts of the country. Canada’s immigration target for this year is 400,00 new immigrants.

Over the past 5 years, housing prices have doubled in Greater Vancouver, accelerated by Covid and the fact that remote work has become the new norm. Even office work is trending into a hybrid model, whereby some office workers will be at the office two days a week and the rest of the time work from home.

Over the past year, home prices have increased by an average of 20 % as more people move into larger homes.

GST / HST on Assignment sales.

The Budget proposes to make all Assignment Sales of newly constructed or substantially renovated residential housing taxable for GST / HST purposes effective May 7th, 2022. The Government wants homes to be lived in and not traded as a commodity. profited by speculators. These taxes have not applied to home buyers intending to live in their homes. The new tax measures are expected to raise $ 6.1 billion over the next 5 years

A new Vancouver home sale record was set at $ 42 Million in 2021, the Point Grey Mansion of prominent philanthropists Joseph and Rosalie Segal.

Mark Carney Canada’s 24th Prime Minister Won the Liberal Leadership by 85.9 percent of the votes cast on Sunday March 9th, 2025

Approval of $40 Billion LNG Project in Kitimat BC

The real estate market in Kitimat, northern BC is on a tear, to accommodate construction workers, in the initial $ 18 Billion Kitimat Marine Terminal, which is the center piece of the $ 40 Billion investment by LNG Canada’s 5 owners including Royal Dutch Shell. It is scheduled to employ 950 permanent workers when exports to Asia start in 2024.

In the meantime, 4500 workers will be required at the peak of the building activity in 2021 and 2022.

First NDP Premier in 16 years

John Horgan was sworn in as the Premier of British Columbia. The first NDP Premier in 16 years with the support of the Green Party to defeat the former liberal Government. He immediately turned his attention to the wildfire crisis in the interior which has displaced some 50,000 people from their homes. Other major issues facing the near government are:

- The softwood lumber dispute with the US, who have increased tariffs for exports.

- Deploying the Kinder Morgan pipeline expansion from Alberta to BC with further reviews.

- Putting future Liquified Natural Gas projects on hold because of the cancellation of the $11.4 billion Pacific North West Venture by Petronas of Malaysia, citing global market conditions.

- Reviewing the $8.8 billion site C electricity project currently under construction at a cost of $2 billion dollars to date, having created 2000 jobs.

The new cabinet consists of 20 gender balanced ministers.

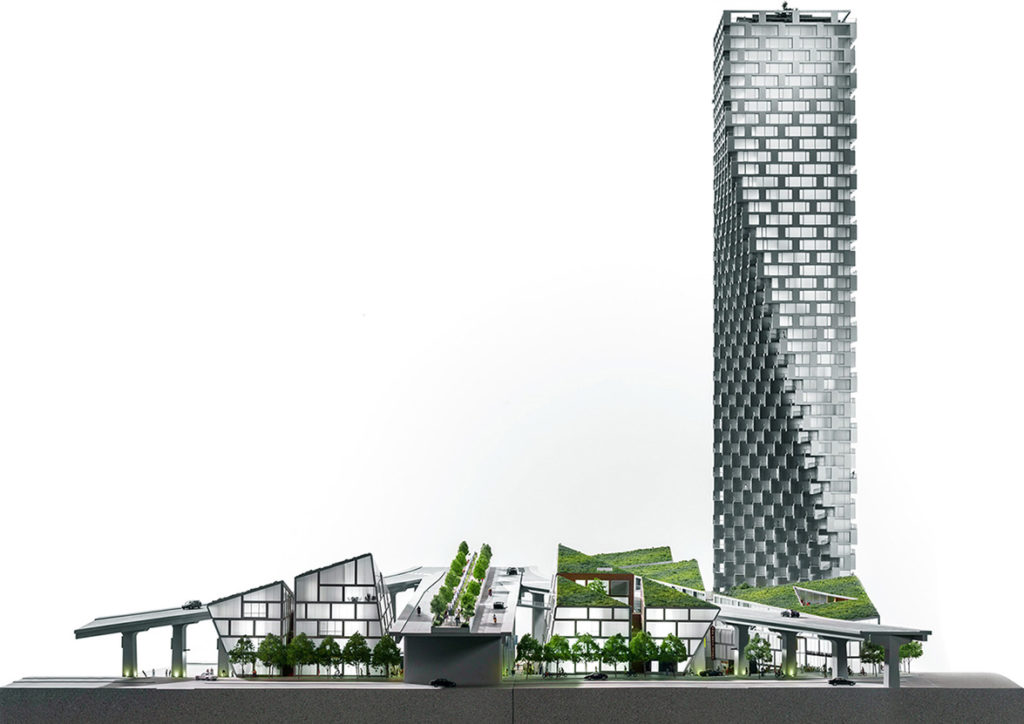

Vancouver’s newest iconic condo building overlooking the north end of the Granville Street bridge is 95% sold.

The developer West-Bank paid $32.4 Million or $15 million per acre for the 2.2 acre site for its eye catching twisting Tower. Land cost for this project was $ 83,000 for each of the 388 Condominiums

It was not the most expensive residential sale in Metro Vancouver in 2017. That year’s top prize went to a site on Alberni Street at $83.5 million for a site measuring less than an acre, which had been up zoned to higher density, resulting in doubling its value since 2014.

B.C. Government adds foreign buyers tax to insulate Metro real estate (Vancouver Sun 26th July, 2016)

A new tax comes into effect on August 1st, 2016, non citizens will have to pay an additional tax of 15% over the existing 2% property transfer tax paid by all purchasers. The Government had to act to stem the red hot real estate housing market which is shutting out locals from entering the market. In 2016 the average price of a Vancouver area home reached $1.5 million, and $3.5 Million in the affluent Westside.

The local MLA David Ebey expressed the overwhelming sentiment of where will the kids who grew up in their parents neighbourhood live? ( Globe & Mail July, 2016 ) With a Provincial election 10 months away this has become a hot button issue. For example a $1 million home for a local purchaser attracts $18,000, whereas a foreign buyer will pay $ 168,000. A $3 million home will attract $68,000 for a local buyer, and $518,000 for a foreign buyer. Some experts predict that this rushed measure will slow down the housing market, and may result in a price correction of up to 15%, however it will be months before the full impact is felt. Between June 10th and July 14th, 2016, almost a billion dollars of houses were sold to foreign buyers, mostly from China.

Retail, Downtown Vancouver

Nordstrom the high end US fashion retailer exited from the Canadian market after 3 years, with the closure of all its stores across Canada in April 2023. In downtown Vancouver it left a huge vacancy of 250,000 sq ft in its prestigious Pacific Centre Mall Complex.

Simons a Quebec based family retailer, occupying 100,000 sq ft at Park Royal Mall continues in business after 3 years, despite the disruption brought about by Covid

Greater Vancouver Re-development Activities

Traditional malls are being reinvented by developers as open air emporiums, combined with residential towers to create an entire community.

1) Sears Site – Metrotown

Concorde Pacific have acquired the Sears site at Metrotown, and building 7 residential towers, having already built 53 towers in False Creek with 19 more to go in the same community.

2) Brentwood Mall – Burnaby

Shape properties are making a total makeover, which when completed will cost up to $ one billion. Surface parking will go underground so people arriving by Skytrain can walk straight into a one acre plaza, flanked by residential towers. The current retail space of 550,000 sq ft will be more than doubled. Longer term plans call for 13 residential towers with 2 new office towers. The transit hub will be a major draw and create a new town centre.Shape properties describe the project once completed as an amphitheatre of activity.

3) Vancouver Airport – Open air designer outlet mall

UK based developer McArthurGlen Group promises luxury piazzas, pedestrian friendly walkways and tree lined streets on a 30 acre site owned by the airport next to Templeton Canada line station.The centre will draw high end brand names such as Prada. Armani , and Burberry .Opening is scheduled for spring of 2015

4) Park Royal – West Vancouver

Originally built by the famous Guiness family, it has undergone major transformation by Larco Developments. They opened Canada’s first open air life style centre with great success. Currently undergoing major expansion, with a residential component of two more towers, which will draw shoppers to the mall.

5) Oakridge Mall – Vancouver

This redevelopment is the creation of a major town centre with 13 residential towers, adding 2900 residents. and two private care seniors facilities , with shops and retail totalling $ 1.5 Billion.

6) Lower Lonsdale – North Vancouver

The waterfront area which is the terminal for the seabus from downtown Vancouver has a $ 25 Million Development plan. which will transform it into a hot night spot, complete with a covered skating rink and a giant ferris wheel. Seattle based Roger Brooks is the brain behind the development. Whistler Village was his first project with 678 people. Today it is a mecca for international travellers.

The federal Governments award of the $ 8 Billion ship building contract has provided a huge boost to the local economy, and rental buildings are selling at a premium with less than 2 % vacancy.

Vancouver Office Market – 2019

The hot office market downtown has a vacancy of 5 percent, the second lowest in North America , and the lowest since 2013. With no new top quality space expected until 2021, rates are expected to reach $75 gross per square foot. Co-working office space seems to be one avenue for smaller businesses wanting to locate downtown and being close to home for its workers.

The tech industry continues to drive job growth and fuel demand, where 50% are tech tenants. To secure themselves, strata office sales are up ranging from $1000 to Bosa’s sold out $2000 per sq foot space at Station Square on Cordova street, across from the Waterfront Skytrain station , and the Seabus terminal to the Northshore.

Transit is driving new developments in commercial and residential real estate .Brentwood in Burnaby is the perfect example of the new office and residential hub across from the Skytrain station. It has developed 5853 residential condos and a further 6,658 are planned as part of the overall revitalization of Brentwood Mall sitting on 14 acres.

Bentall Centre in downtown Vancouver sold to US investors for an undisclosed price in May 2019, and expected to complete by year end.

The office Towers were last sold to in 2016 to China’s Anbang Insurance Group, which paid $ 1.06 Billion. At the time it was the largest office complex to be sold in BC history. The present deal at an undisclosed price is probably the largest of the decade.

The buyers are led by Blackstone Property Partners (BPP) and Hudson Pacific Properties out of Los Angeles, BPP will own 80% of the 1.45 million square feet complex, with Hudson Pacific owning 20%.

Hudson Pacific will serve as the operating partner, and Blackstone as the Managing Partner.

The property is considered to have additional development potential ( Western Investor, May 2019 )

A local group that includes reliance properties and kingsett capital bought the 26 storey macblo office Tower on West Georgia Street in March 2019, designed by the renowned Vancouver architect Arthur Erickson.

The two sales alone account for 50 % of 2018’s office sales volume, and reveals the sectors staying power. Half a century old buildings still attract blue chip tenants, global buyers and billion dollar level bids.

Credit Suisse enters downtown office market

Construction of a $ 200 million office tower of 369,000 sq ft. the heart of the financial district is underway and will be a tour de force incorporating the Old Stock Exchange building. Credit Suisse is one of the top 10 largest real estate investors in the world.

German Pension fund cashes in $100 m profit in 3 years!

Bentall V changes hands in 3 years with a tidy $100 million profit for German Deka Immobilien investment. Bentall Kennedy announced the $401 million purchase on behalf of Canadian Pension fund client. The 33 story, 583,000 sq ft triple A office tower is a trophy asset. The long term prospects for Vancouver’s market are excellent.

Deka acquired the building for $297 Million in 2009, and paid the highest price for a single asset in Metro Vancouver, said Paul Richter National research manaager for RealNet Canada Inc.

The overall vacancy rate for Metro Vancouver increased over the first quarter to 8.7 % from 8.5 %, and almost one percent higher than 2013. Negative absorption trends are expected to continue through 2014, until 2015 when occupancies are expected to pick up. The trend towards suburban office demand is increasing nearer public transit and Sky Train stations. ie Stantec has committed to lease 60,000 sq ft at Metrotown Tower 3, and Coast Capital to more than 100,000 sq ft making King George Station in Surrey its new head office location.

Investors snapped up $1.4 billion of commercial real estate in the first half of 2012, shattering the record set in 2010. $115 million was invested in acquiring 50% of 401, West Georgia and 800 Burrard in downtown Vancouver. More than $700 million was invested in office buildings in 2012.

The retail sector saw 30 transactions totalling $498 in the first 6 month period of 2012.

The lack of quality industrial product remains a challenge. Dollar sales volume for 2012 was $212 million.

There is more than 400 million sq ft of office space in Canada, of which 162 million is in the Greater Toronto Area (GTA), followed by Montreal, Calgary, and Vancouver, according to statistics from Cushman Wakefield. In the next two years the GTA will add another 10 million sq ft, of which 3 million will be downtown.

Hotel Georgia Acquired by a local investor group for $140 Million in June of 2017

Major Hotel Sales in 2014 & 2015

Canadian hotel trading volume reached over $ 1.4 Billion in 2014, the second highest since the last peak in 2007 Full service assets dominated volume with headline sales including the Park Hyatt, Toronto, Hyatt Regency, Vancouver, The Fairmont Empress Hotel on Victoria’s waterfront, and Hotel Vancouver in June of 2015.

The Empress Hotel in Victoria sold to Bosa Developments for $ 45 million

Hotel Vancouver Acquired by Larco Group for $ 180 million

The City’s fabled Westin Bayshore Hotel (511 rooms & Convention centre), next to Stanley Park, once home to Howard Hughes is under contract, at a premium $ 290 million price by Concord Pacific because of its development potential at Coal Harbour on its 2.4 hectare site. The Bayshore was in the news five years ago, when it became part of a five hotel deal with Starwood Capital and partners from the Middle East, for $745 million. At the time the Bayshore was valued at $ 151 million (Globe & Mail September 4th, 2015)

Tourism and Hotel Sector

Apartment Market Strong

The multi-family family sector saw 53 apartment transactions in the first half of 2012 for a total of $216 million. The largest transaction was the sale of four tower Lougheed Village at $80 million, the third largest apartment transaction in BC. It is home to 528 tenants, 21 commercial units with a gross rental income of $7.4 million in 2011. Previous sales were Langara Gardens in 2009 at $157 million and Beach Towers for $117 million.

The Aqualini Group have just announced the development of 614 rental suites next to the Rogers Arena. Low vacancy rates and record low interest rates are encouraging new investment in the lowest risk category.

Abbotsford

Abbotsford is a healthy city in terms of its economy and its health care system. It is the 5th largest City in BC, with a population of 133,497 according to the latest census. The population is projected to increase to 212,000 by 2036. The number of households has more than doubled in the past two decades. Residential areas have grown so quickly that high density planning is a major mandate of the local council according to its Mayor Banman. The average price of a detached home in Abbotsford is $ 434,000 compared to Langley ( $ 548,000) Cloverdale ( $548,000) and White Rock/ South Surrey ($875,400 )

Agriculture is still the biggest economic force in the City. Fraser Valley produces over 70 % of BC’s dairy products, berries, vegetables. Poultry, eggs, pork, greenhouse vegetables, mushrooms, floriculture and nursery products. One in four private sector jobs in the City relies on agriculture. Farming supports 11,000 jobs and generates $ 1.8 Billion in economic activity

The construction of the 44 acre Fraser Valley Auto Mall in 1992, gave a major impetus to the retail sector. Currently a $ 200 million shopping mall of 560,000 square feet known as High Street is nearing completion across from the Auto Mall. During the past decade, Abbotsford has annually added between 800,000 and 2 million square feet of commercial, industrial and Institutional space.

A 147 room Sandman hotel is being built in this commercial hub, scheduled to open in 2014, at an estimated cost of $ 10 million.

Abbotsford International Airport had 490,000 passengers last year with daily flights to Toronto, Calgary and Edmonton. Its world famous International Airshow celebrated its 50th anniversary in 2012. It is the home for Cascade Aerospace’s 250,000 square feet maintenance facility which has the contract for Canada’s fleet of Hercules lift aircraft.. The airport has the potential to become Western Canada’s hub for aerospace, and is vital to the local economy. Adjacent to it is TRADEX, a facility of 100,000 square feet for trade shows and exhibitions.

At 60,000 square feet, the Abbotsford Regional Hospital which opened 4 years ago at a cost of $ 300 million serves more than 1.6 million people and has an annual budget of $ 2.6 Billion. The Fraser Valley Health Authority has a staff of 26,000. 2500 physicians and 6500 volunteers.

Abbotsford with its key transportation routes, a major airport, proximity to the US border and Metro Vancouver assures it of continuous growth, and an excellent city to live and work.

Surrey

This is the fastest growing city in Canada, expected to over take the City of Vancouver by the next decade. The arrival of the skytrain, Simon Fraser University Campus, and the new billion dollar Port Mann bridge have made for easy access.Over the next 20 years 70 % of future developments are expected to take place south of the Fraser River ie Richmond, Surrey, Langley and Abbotsford, Surrey City Centre is changing with its new City Hall, At its epicentre standing 164 meters high, 3 Civic Plaza will be the tallest tower south of the Fraser River and one of the 5 highest structures in the Metro Vancouver region. This will be Surrey’s first mixed use tower, with a 144 room Marriott hotel and convention centre, with 349 residential condos adjacent to the hotel. to date over 200 homes have sold, wit prices starting at $ 250,000 and up to $ 1.2 million. Expected date for completion is November 2016.

Whistler

Whistler Resort attracts US buyers with a cheap Canadian Dollar.

The plunging C $ is attracting renewed interest from US buyers for resort properties, which has increased from 6% of the purchasers in 2014 to 12 % in 2015. This trend is likely to continue for the rest of 2016, after a four year lull. Whistler is now a year round resort, and with the improved highway built prior to the very successful 2010 Winter Olympics has become internationally renowned.

Squamish

Squamish is a growing community with a population of 16,000 half way to Whistler, Canada’s premier winter resort, and only a 45 minutes drive from West Vancouver. Squamish has benefited from the 2010 Winter Olympics, and with the upgraded highway is likely to become a more affordable bedroom community for the Northshore of Vancouver and the Whistler resort community.

The newly established Quest University is helping to establish Squamish as a university town. The past few months have slowed the pace of new developments, however the past few years have seen the approval of 2000 residential units, which are more affordable than Whistler or West Vancouver. Moreover, families like living in a small safe university town.

Quest University in Squamish, on its 18 acre site closed in April 2023. Capilano University acquired it for $ 63.2 million with support from the Provincial Government of $ 48 Million. It is expected to reopen as a private university in 2024.

Victoria

Located on the southern tip of Vancouver Island, which is the largest of British Columbia’s 6500 islands. It is a favoured community of choice for its temperate climate, natural beauty, recreational sites, and superior economic opportunities. It is the seat of the Provincial Government, and one of its most important economic drivers is its tourism industry, education, retirement, and recreational industries. It’s strategic location is a gateway to the Pacific Rim, and its proximity to the US markets, with excellent transportation links by sea and air, has made it the second most important hub for business development and economic investment in the Province, after Vancouver.