Alberta

2023 Alberta General Election

On May 29th, 2023, the United Conservative Party under Danielle Smith was re-elected with a 49 seat majority and 52.63% of the vote.

Office Market

BOW SOLD FOR $ 1.2 Billion by H&R REIT to Oak Street Real Estate, based in Chicago

The Bow In Calgary

By Florian Fuchs, CC BY 3.0, https://commons.wikimedia.org/w/index.php?curid=20934150

Oak Street Real Estate buys Western Canadian Place in Calgary for $ 475 Million

Western Canadian Place in Calgary By Surrealplaces, CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=2073215

Alberta Oil Sands – Canada poised to capitalize on global oil demand.

With the dramatic rise of the Chinese economy, the stage is set for Canadian oil sands firms to capitalize on the increased global demand for oil. However, efficient transportation of Alberta crude to Asia bound tankers on the West Coast is essential.

According to estimates the lost revenue stream last year for not having a diversified export market was about $ 19 billion says Chris Seasons, President of Devon Canada Corporation an oil and natural gas exploration and production company. That loss has an impact through the whole value chain. It is a loss for the oil companies and the Federal and Provincial Governments.

He said he was aware of British Columbia’s concerns. BC needs to see the benefits of taking on the risk, and the industry has work to do to gain their trust.

From a Canadian perspective, high demand will keep prices up and lead to export growth. Canada also needs billions of dollars to develop its energy resources and Asian investments should be welcomed.

Calgary

As rapidly home prices take foot in the major cities across Canada, more home buyers are looking towards Calgary which missed out on the real estate boom of the Covid pandemic.

The Ukraine crisis has pushed up the price of oil to close to the $ 100 a barrel range, giving the economy a renewed bounce.

Calgary has one of the highest median household incomes in the country at $ 99,583 in the last census, plus big city amenities and great geography. It has a young well-educated workforce. Toronto today is considered the most overvalued city in Canada today, followed by Ottawa, Montreal, and Vancouver (Alberta Central Credit Union Report – July 7th, 2021 – Globe & Mail).

The Calgary economy is still energy-based, and subject to volatility, with diversification to High tech industries, and Clean Energy underway.

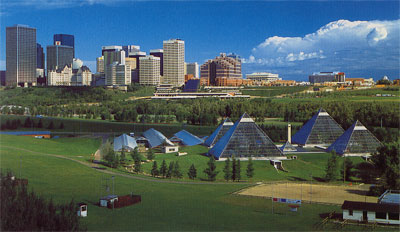

Edmonton

Arena Development – Future Home of the Edmonton Oilers

More than the $ 450 million Arena complex scheduled for completion in 2014, the new home of the Edmonton Oilers, the Downtown Business Association of Edmonton report states that roughly $ 4.8 Billion in developments is anticipated as a spin-off in the coming 5 years.

The Province has committed $ 340 million for a new Provincial Museum in the area, and it is expected that this activity and the Arena complex may generate housing/condo activity up to $ 766 million.

The key to the puzzle is the Arena, for which the Mayor has issued a “drop Dead “ timeline of 16th October 2012, after 4 years of intense negotiation.

Edmonton Apartment Market

Optimism continues to drive the Edmonton and Alberta economies. The Alberta GDP is predicted to grow by 3.9 % in 2014, outpacing the national average of 2.6 %. Multifamily properties continue to entice purchasers seeking a stable cash flow investment. Vacancy at just over 1 % coupled with escalating in-migration fuelled by impressive job growth provides a compelling reason to buy. In 2013 employment accounted for 80,000 jobs, resulting in job seekers not seen in 25 years. Capitalisation rates in 2013 averaged 6.1 %. The total transaction volume in 2013 was $ 325 Million. Volume was up by 55 % over 2012 . During 2013, 71 buildings sold comprising 2,484 units for an average of $ 130,850 per unit. The numbers were skewed by some new hi rise institutional grade buildings in 2013. The average price for a wood frame walk up apartment building built prior to 1990 with less than 50 units was $ 110,317 per suite. Average rents in 2013 increased by 5.6 %. Rents have increased every year since 1995, with the exception of 2009 when rents decreased.

Red Deer

Red Deer is located midway between Calgary and Edmonton, approximately one and half hours drive from each city on Highway 2. It has a population of just over 100,000 and represents a major regional service centre for a larger rural trading area. Hotels being offered for sale are:

- Full service renovated property of 65 rooms.

Motivated Vendor

Price $3.6 Million - Franchised rooms only hotel in a high visibility location, 100 Rooms.

Asking Price $10 million, open to offers